Our Research Methodology: How We Build Reliable Market Intelligence

1. Defining Research Scope & Objectives

The first step in any high-value market study is clear research scoping. We begin by specifying the:

- Market segments to be analyzed (e.g., product types, applications, end-use industries)

- Geographic regions and time periods for forecast and historical analysis

- Business questions the report must answer (growth drivers, trends, competitive landscape)

This forms the foundation for structuring data collection, segmentation design, and analytical models that follow.

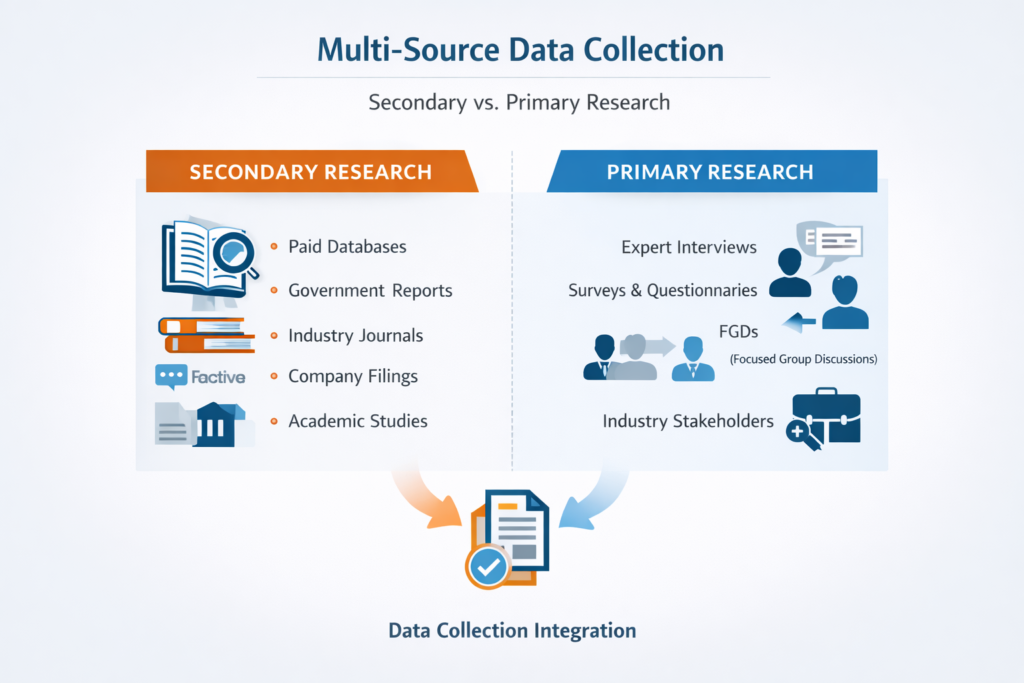

2. Multi-Channel Data Collection

Accurate insights start with reliable data. Our reports use a multi-layered data collection strategy:

A. Secondary (Desk) Research

We gather data from robust external databases and publications:

- Paid sources: Factiva, Hoover’s, industry journals

- Government and regulatory data

- Company filings, investor presentations, white papers

- NGO, trade association statistics and academic research

This ensures a broad and validated starting dataset.

B. Primary Research

Primary research strengthens accuracy through firsthand input:

- Expert interviews with industry stakeholders – executives, consultants, and subject matter experts

- Structured questionnaires and surveys with buyers, manufacturers, and technical specialists

- Focused group discussions (FGDs) to refine interpretation

Primary interactions are critically reviewed to reduce bias while deepening insight into market dynamics.

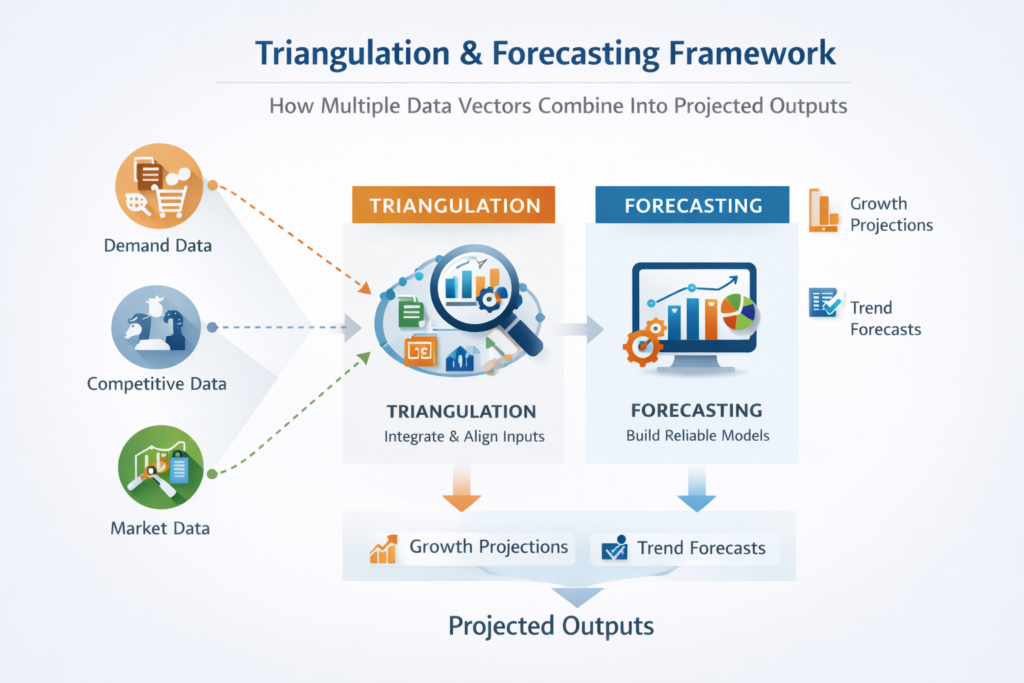

3. Data Validation & Triangulation

Data Bank Verification

We cross-check secondary and primary data against existing internal and public datasets on key variables such as:

- Revenue figures

- Market penetration levels

- Competitive activity

- Growth signals across segments

This automated and manual reconciliation ensures consistency and reliability before analysis.

Triangulation of Insights

Where several independent data points exist for a variable (e.g., demand figures, price trends), we compare and align them to establish:

- Consistent baselines

- Range estimates

- Best-fit forecasting inputs

Triangulation reduces dependence on any single source and strengthens confidence in outputs.

4. Analytical Framework & Estimation

After validation, we apply robust analytical frameworks to interpret and model the data:

A. Forecasting Approaches

We use a mix of modeling techniques:

- Bottom-Up Estimation – summing segment level demand across categories

- Top-Down Projection – evaluating total market potential and refining with adoption curves

- Combined Models – integrating both methods for complex product or multi-region markets

These approaches help produce reliable forecasts and growth estimates.

B. Value-Chain & Segment Analysis

Market sizing is supported by both:

- Supply-side evaluation – revenue share analysis, product flows

- Demand-side evaluation – end-user adoption trends and usage penetration

Applying both perspectives ensures comprehensive interpretation of market forces.

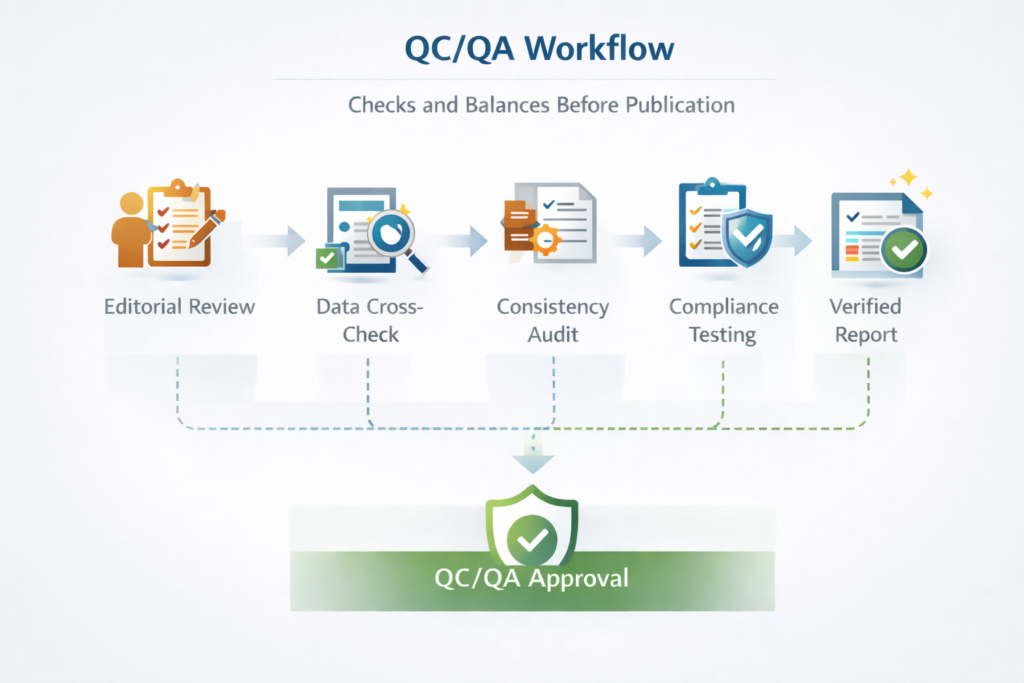

5. Quality Control & Quality Assurance (QC/QA)

Before any findings are finalized, our QC process includes:

- Editorial review by industry analysts

- Cross-review of numeric tables and visual data

- Consistency checks between narrative and figures

- Compliance testing vs. scope and objectives

This final stage ensures the published content is free of error and ready for strategic decisions.

6. Report Delivery & Customization Support

We deliver market insights in a format optimized for executive use:

- Clear segmentation charts

- Forecast models with transparent assumptions

- Competitive landscape profiling

Additionally, clients can request customization to adjust region, timeframe, or segmentation focus – ensuring the methodology can adapt to specific business needs.